Pork producers and their herd veterinarians rely on science and research results to make sound business and swine health decisions. The Pork Checkoff plays a key role in this process, providing data from research, equipping producers and veterinarians with guidance for enhancing performance, improving pork quality, and, whenever possible, fueling profitability.

The same reliance producers and veterinarians have on data extends beyond production to an equally essential function of the Pork Checkoff, growing demand. That is where National Pork Board’s (NPB) Consumer Connect research comes in. “This research helps us learn even more about our core consumers, delivering new and updated insights on how different segments prioritize different needs,” said Dr David Newman, senior vice president, market growth, National Pork Board. “For example, we know consumers make choices about food based on taste, nutrition, and convenience; we can help them develop a preference for pork by showing them that it can meet the needs they find most important in their own lives.”

The US Department of Agriculture (USDA) Economic Research Service data from 2023 shows per capita consumption of pork totaled 50.2 pounds.1 However, not each of the 334.9 million US residents consumed that amount of pork. The NPB’s Consumer Connect research helps shed light on who is, and is not, eating pork and informs a new way to drive pork growth by understanding consumer needs.

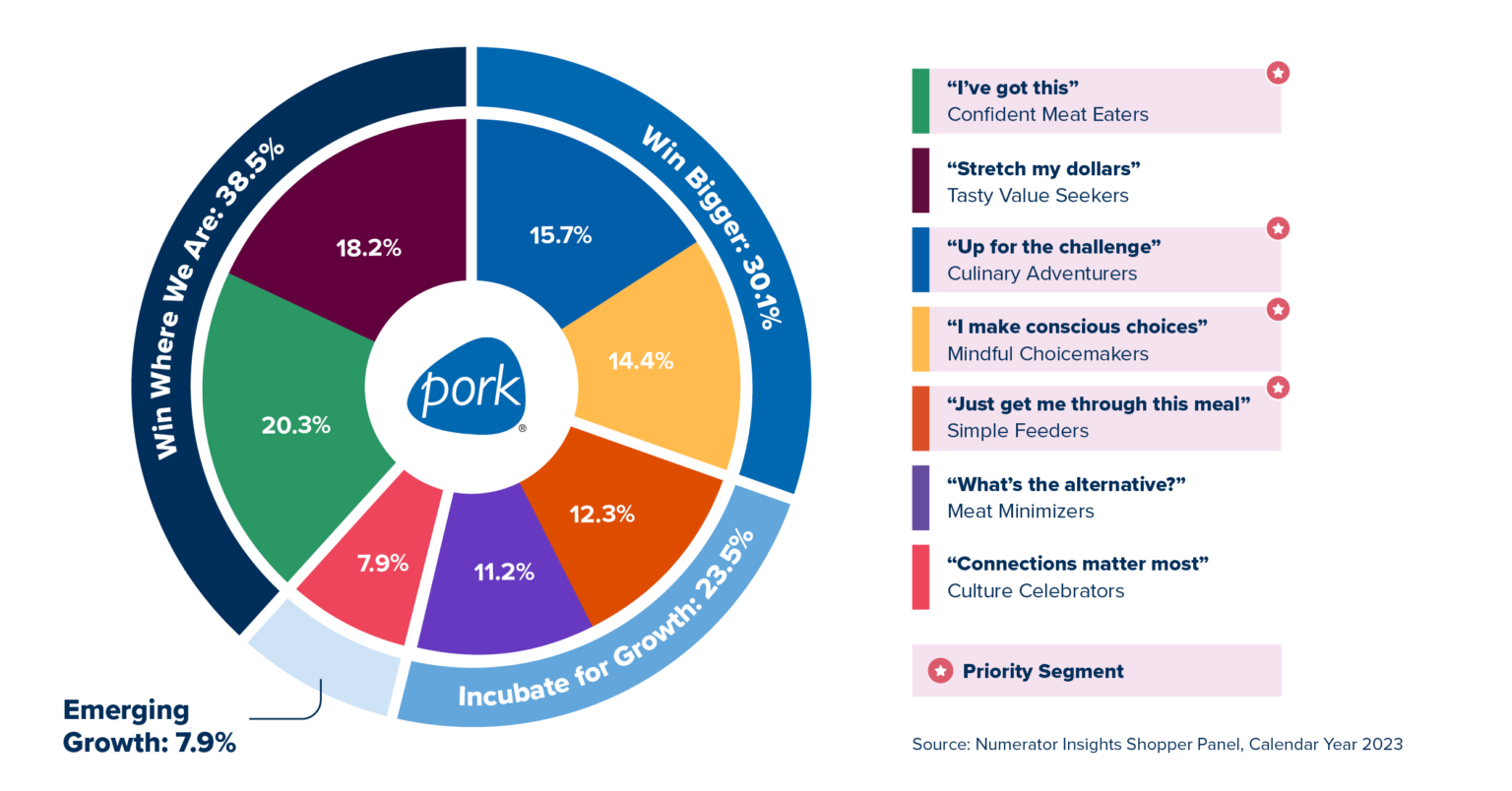

The research revealed 7 distinct consumer segments defined by their motivations, needs, and emotions. Of these 7 segments, Confident Meat Eaters, Simple Feeders, Culinary Adventurers, and Mindful Choicemakers were identified as priority segments and Tasty Value Seekers, Culture Celebrators, and Meat Minimizers were identified as secondary segments. Definitions of each segment are available on the Pork Checkoff website (porkcheckoff.org/pork-branding/consumer-connect), which also includes a quiz to help you identify the type of consumer you are (segment.porkcheckoff.org). Using the science, NPB will focus on what is important to these consumers, to improve its approach to positioning, activation, and measurement in the marketplace – ultimately making pork more relevant and generating long-term, sustainable demand.

The quality of research data is reinforced by replication and validation. Consumer Connect data was evaluated by Dr Glynn Tonsor, professor, Department of Agricultural Economics at Kansas State University. Dr Tonsor leads the Meat Demand Monitor (MDM), a project tracking US consumer demand, perceptions, and preferences for meat that is jointly funded by the Pork and Beef Checkoff programs.

The MDM surveys over 3000 people each month to analyze consumer consumption, demand, and preferences of meat in both the retail and food service channels. As a testament to impact and broad interest in the MDM, Dr Tonsor regularly shares the latest MDM insights at key industry events including World Pork Expo, Annual Meat Conference, and USDA’s Agricultural Outlook Forum.

“I often say you can only manage what you measure. Whether we are talking sow pregnancy rates, barrow feed efficiency, pork chop consumption, or willingness to pay for bacon, we can only improve the hog-pork industry by careful measurement to guide strategic decisions. The MDM is intentionally designed to aid with pork consumption and demand issues,” Dr Tonsor said.

During the October 30, 2024 Global Hog Industry Conference, Dr Tonsor said MDM validated NPB’s consumer segmentation research (Consumer Connect). He noted the relative size and composition (gender, income, pork consumption, etc) was very consistent between two independent data sources and analyses. The MDM research encompassed input from more than 21,000 respondents from March through September 2024.

The MDM team looked in greater detail at the segments defined by Consumer Connect among its respondents, offering additional insights to NPB for implementation in its new consumer marketing campaign launching in 2025. For instance, the MDM 2024 assessment revealed greater distinction across consumer segments in retail than food service demand highlighting that market channel specific plans hold merit. The full MDM report is available via AgManager.info along with all MDM project resources.2

“The MDM was launched to provide unbiased tracking of domestic meat consumption, demand, and preferences with a goal of enhancing decision-making by those in the US meat-livestock industry. The latest application of rich MDM data to verify and extend NPB’s consumer segmentation research is an excellent example of the MDM delivering on its goal,” Dr Tonsor said.

Measurement of economic and marketing results are central to NPB’s mission to grow pork demand in a targeted, informed manner. Being able to verify and measure results will signal a positive return on investment. “The world increasingly is characterized by more data than was previously available. Said data only has value when it is applied to improve decisions. In this situation, the MDM is a relatively new data resource that not only is unique in richness but increasingly delivers on its goal of improving decisions following unique insights from ongoing data collection and assessment,” Dr Tonsor said. “As the world continues to evolve, projects such as the MDM can help industry keep pace and hopefully by extension improve economic viability of industry participants.”

Application of consumer demand science will culminate in an upcoming targeted outreach effort. “The most exciting piece of this process is what’s coming in 2025. It’s time to take our research and turn it into action for the pork industry, protecting our long-term position with consumers,” Dr Newman said. “Working with industry partners, we are developing our biggest consumer outreach campaign in 25 years! This bold new approach, which is being introduced to the industry in March 2025, is about leveraging our long-term position and building support within the entire pork value chain.”

References

1. US Department of Agriculture Economic Research Service. Livestock and Meat Domestic Data – meat supply and disappearance tables, recent. Updated December 31, 2024. Accessed January 13, 2025. ers.usda.gov/sites/default/files/_laserfiche/DataFiles/104360/MeatSDRecent.xlsx?v=34014

2. Tonsor G. Meat Demand Monitor: A Deep Look at US Consumer Segments. November 19, 2024. Accessed January 13, 2025. agmanager.info/livestock-meat/meat-demand/monthly-meat-demand-monitor-survey-data/meat-demand-monitor-deep-look-us